By Andrew Moran

The U.S. economy grew more strongly in the third quarter than initially estimated, driven by solid consumer spending and a pickup in exports.

Real GDP rose at an annual rate of 4.4 percent during the July–September period, according to new data from the Bureau of Economic Analysis released on Jan. 22.

This represented a slight 0.1 percent upward revision from the initial estimate.

The bureau noted the adjustment reflected upward changes to exports and investment, which helped offset the tepid downward revision to consumer spending.

Real consumer spending advanced by 3.5 percent, up from the 2.5 percent registered in the second quarter.

Exports, which contribute to GDP growth because they account for goods and services produced domestically and sold abroad, soared 9.6 percent. Imports fell 4.4 percent following a more than 29 percent decline in the second quarter.

The jump in real GDP was fueled primarily by strong gains in private industries—a 5.3 percent increase in services and a 3.6 percent increase in goods production—though these were slightly tempered by a 0.3 percent dip in government output.

Corporate profits also bolstered third-quarter growth, totaling $175.6 billion—an upward revision of $9.5 billion. This represented a 4.5 percent surge from the previous quarter.

On the inflation front, the GDP Price Index—a measure of prices for all goods and services produced in the United States—climbed 3.4 percent from 2.1 percent in the April–June span.

Bullish Forecasts for Q4

Despite the 43-day government shutdown, fourth-quarter growth prospects are elevated.

The Atlanta Federal Reserve’s widely watched and oft-cited GDPNow Model estimate indicates the October–December 2025 period will deliver a 5.4 percent expansion.

A deeper dive into the regional central bank’s forecasts suggests growth was fueled by consumer spending, net exports, and business investment.

If accurate, full-year growth will be almost 3 percent, far higher than the 2025 Blue Chip forecast of 2.1 percent.

This has the current administration anticipating another solid year for the U.S. economy.

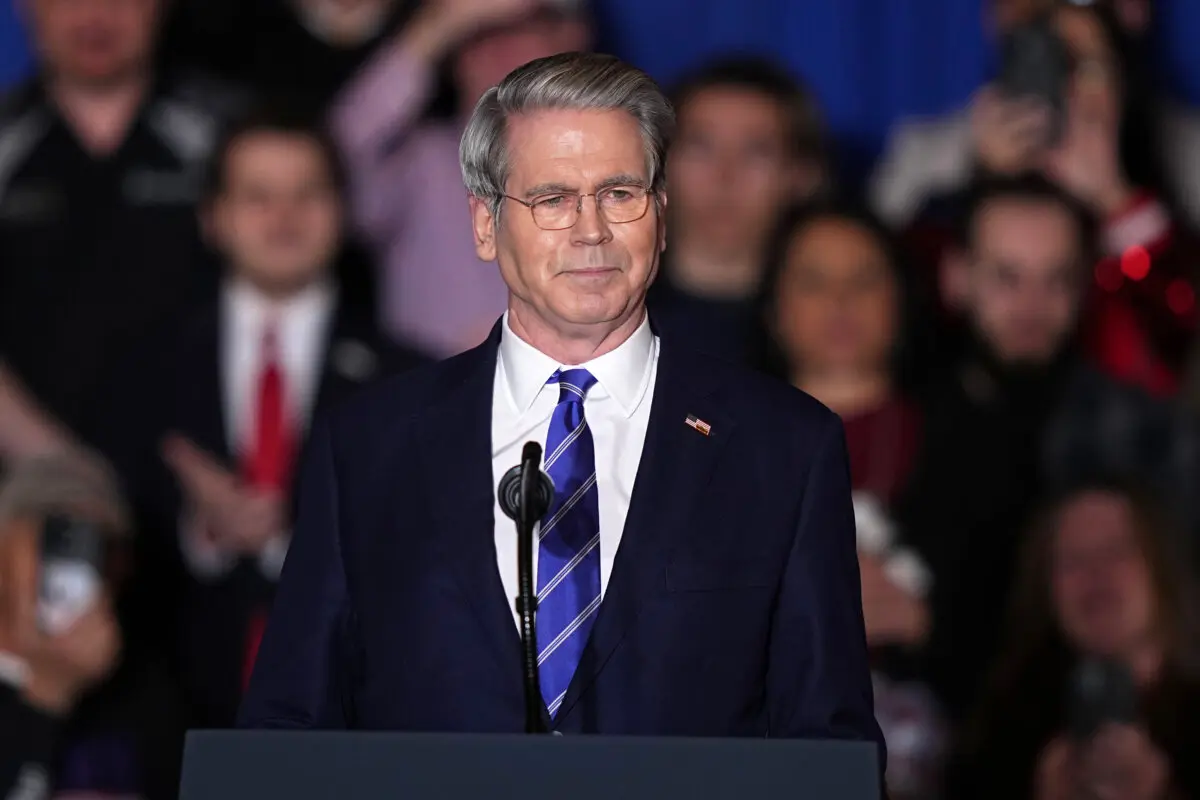

Appearing in Davos for the World Economic Forum this week, Treasury Secretary Scott Bessent projects the economy will grow as much as 5 percent—after adjusting for inflation—in 2026.

“We are going to see a very, very strong economy this year. We could see between 4 and 5 percent real growth, which would mean 7 or 8 percent nominal growth,” Bessent said at a Jan. 20 press conference.

Commerce Secretary Howard Lutnick says growth would be even higher if interest rates were lower.

“Our rates should be much lower so that our economy can finally flourish. I think we’re going to grow more than 5 percent GDP this quarter, and that’s for the $30 trillion U.S. economy,” Lutnick said during a World Economic Forum panel.

“And if rates were lower, you would see us hit 6 percent. What is holding us back is ourselves.”

The White House has been pushing for the Fed to cut interest rates swiftly.

After three straight quarter-point rate reductions, the central bank is expected to hit the pause when monetary policymakers convene their two-day meeting next week.

Futures market data suggest the Fed will not lower the benchmark policy rate again until late spring.

It is not only the White House that is projecting robust growth this year. A growing chorus of private-sector economists has become optimistic about the year ahead, citing fiscal policy stimulus, continued artificial intelligence (AI) buildout, and lower rates.

Goldman Sachs researchers say annual growth will be 2026, higher than the consensus estimate of 2.1 percent. The key risk, however, is deteriorating employment conditions.

“Our strongest conviction views for 2026 are our above-consensus GDP growth forecast and our below-consensus inflation forecast,” David Mericle, chief U.S. economist, said in a Jan. 15 research note. “The outlook for the labor market is more uncertain—we expect it to stabilize but see the possibility of further softening as the key risk for 2026.”

While a slowing labor market is a concern, some economic observers believe the economy can accelerate without blockbuster job growth.

The economy can expand based on productivity, says Nancy Tengler, CEO and CIO of Laffer Tengler Investments.

“I have been focused on productivity, and it is pretty compelling,” Tengler said in a note emailed to The Epoch Times.

“I have drawn the analogy to the 90s for years, and it looks like we are seeing the same kind of productivity-driven growth. Though I believe this one is deeper and likely more sustainable.”

Tengler referenced the higher-than-expected 4.9 percent productivity increase registered in the third quarter and the upwardly revised 4.1 percent increase in the second quarter.

Labor Market News

In addition to GDP figures, new employment data were also released on Jan. 22.

Initial jobless claims—the number of individuals filing for unemployment benefits—were little changed at a historically low 200,000, below economists’ expectations.

Continuing jobless claims declined for the second straight week, reaching 1.849 million. Recurring claims represent the number of jobless individuals currently receiving unemployment benefits.

Economists monitor recurring claims because they can reflect the challenge workers may have in finding employment.

Despite the positive data, payroll growth could be slowing.

U.S. private employers added an average of 8,000 jobs per week in the four weeks ending Dec. 27, according to payroll processor ADP.