By Andrew Moran

President-elect Donald Trump announced on Jan. 7 a $20 billion foreign investment to construct new data centers across the United States.

While speaking to reporters at his Mar-a-Lago residence, Trump said the funds would be allocated to establish new data centers in the Midwest and Sun Belt regions. According to Trump, the initial phase will take place in Arizona, Illinois, Indiana, Louisiana, Michigan, Ohio, Oklahoma, and Texas.

Emirati billionaire businessman Hussain Sajwani said he has waited for four years to bolster investments in the United States.

“It’s been amazing news for me and my family when Trump was elected in November,” the founder of global property development company DAMAC Properties told reporters at Mar-a-Lago.

“For the last four years, we’ve been waiting for this moment, and we’re planning to invest $20 billion, and even more than that, if the opportunity the market allows us.”

Trump reiterated his pledge to expedite the permit process if businesses or individuals invest at least $1 billion in the U.S. economy.

“This commitment further underscores that many of the greatest business leaders on Earth are seeing a very bright economic future for America,” he said.

Sajwani is the latest foreign business leader planning to make large investments in the United States after Trump defeated Vice President Kamala Harris in the November presidential election.

Last month, Trump announced that SoftBank, a Japanese tech-investing titan, will invest $100 billion in the U.S. economy over the next four years.

From his Mar-a-Lago residence, Trump and SoftBank CEO Masayoshi Son promised that the hefty investment would create at least 100,000 jobs, focusing on artificial intelligence (AI) and related infrastructure.

“My confidence level in the economy of the United States has tremendously increased with his victory,” Son stated.

Son and Trump made a similar announcement shortly after Trump’s 2016 election victory. The SoftBank chief agreed to invest $50 billion in the United States and create 50,000 jobs.

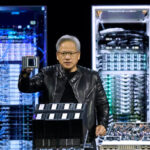

American technology companies plan to spend billions this year to accelerate their AI capacity.

“The perception of the whole world is different,” Trump said at Tuesday’s news conference.

Offshore Drilling

Trump said the Biden administration is trying to make it a difficult transition.

“I’ve been disappointed to see the Biden administration’s attempt to block the reforms of the American people and what they voted for,” Trump told reporters on Tuesday.

The president-elect confirmed again that he intends to undo President Joe Biden’s executive decision to ban future offshore oil and gas drilling in parts of the Atlantic and Pacific oceans.

“President Biden’s actions yesterday on offshore drilling, banning offshore drilling, will not stand,” Trump said. “I will reverse it immediately. It’ll be done immediately. And we will drill, baby, drill.

“They took away 625 million acres of offshore drilling. Nobody else does that … but we’ll put it back. I’m going to put it back on day one.”

Based on a 70-year-old law, Biden prohibited new oil and gas leasing across 625 million acres of U.S. oceans. The decision is permanent, and there has been debate about whether the incoming administration can legally reverse this measure.

Trump said the latest move harmed the economic viability of ocean drilling, which accounts for 15 percent of domestic energy output.

This environmental decision contradicts the president-elect’s plans to expand energy production, which he says will lower prices and help power the AI boom.

Trump thinks an accelerated energy boom will bring down grocery prices.

“I think you’re going to see some pretty drastic price reductions,” he stated.

Since January 2021, food prices have increased by 23 percent, according to the Bureau of Labor Statistics.

Additionally, an all-of-the-above approach to the energy portfolio will be crucial to facilitate the AI wave.

Over the last year, experts have predicted that the AI revolution will dramatically expand data center power demand.

Barclays Research analysts forecast that the AI wave will double data center electricity power demand by 2030.

Goldman Sachs Research says data center power demand will soar by 160 percent by 2030.

“At present, data centers worldwide consume 1-2% of overall power, but this percentage will likely rise to 3-4% by the end of the decade,” said Goldman Sachs analysts in a report published in May 2024. “In the US and Europe, this increased demand will help drive the kind of electricity growth that hasn’t been seen in a generation.”

Michael Barr Resigns

Michael S. Barr, the Federal Reserve’s vice chair for Supervision, announced on Jan. 6 that he will resign next month, more than a year before his term expires.

Barr plans to remain on the Federal Reserve Board of Governors until January 2032.

The central bank’s top regulatory cop said he wanted to avoid a “dispute” over his role.

“The risk of a dispute over the position could be a distraction from our mission,” Barr said in a letter to President Joe Biden. “In the current environment, I’ve determined that I would be more effective in serving the American people from my role as governor.”

Trump told reporters at Tuesday’s news conference that he will name Barr’s replacement soon.