By Tom Ozimek

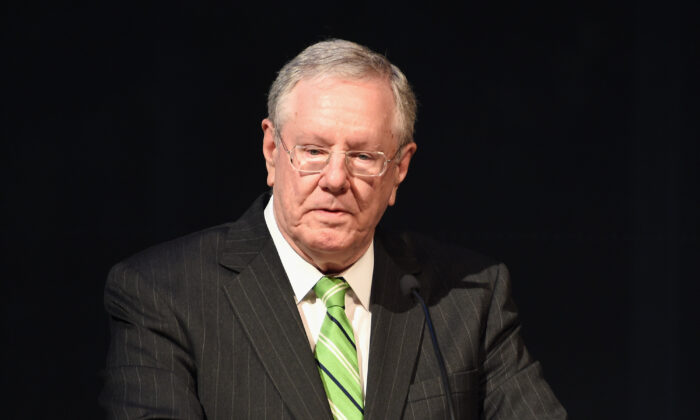

Steve Forbes, chairman and editor-in-chief of Forbes magazine, told Fox Business Network that President Joe Biden will get blowback for his “happy talk” on inflation, while insisting America is in a recession even if the downturn isn’t yet official and blasting the Federal Reserve for hiking interest rates too aggressively and “making people poorer.”

Program host Stuart Varney kicked off the segment by expressing reservation about Biden’s remarks in an interview on CBS’ “60 Minutes” in which the president said that the monthly inflation rate was so low as to be basically negligible and that price pressure would continue to ease going forward.

Varney said he disagreed and predicted a “very difficult inflationary winter,” before asking Forbes to weigh in.

Forbes took a sympathetic view on that forecast, saying that “we’re going to have a hard winter and the Europeans are going to have it even worse.”

Biden’s ‘Happy Talk’ on Inflation

Further addressing Biden’s remarks, Forbes said the president “overlooked” that inflation rising at 0.1 percent month-over-month pace in August—which Biden characterized as having inched up “hardly at all”—was higher than analysts expected and so was “disappointing” to markets.

“This happy talk is going to hit him back hard,” Forbes said of Biden, adding that the president is “doing all he can to make it impossible to recover from the inflation that comes from disrupting supply chains” with his anti-fossil fuel policies that will put energy prices up.

Forbes then predicted that the Federal Reserve would continue to hike interest rates and push the country deeper into a recession.

“That’s the only way they know how to get down prices—it’s by depressing the economy,” he said. “Not the right way to do it and we’re all going to pay the price.”

‘Making People Poorer’

The Fed will raise its benchmark interest rate by three-quarters of a point on Sept. 21 for a third consecutive meeting, according to fed funds futures contracts, which give 80 percent odds for a 75 basis-point hike and a 20 percent chance for a bigger 100 basis-point boost.

Forbes said the Fed is “drastically” raising interest rates into an economic downturn, adding that he believes “we’re in a recession,” regardless of whether that designation is not yet official. The rule-of-thumb definition for a recession is two consecutive quarters of negative GDP growth, which the United States recorded earlier this year. But the National Bureau of Economic Research (NBER) Business Cycle Dating Committee—the official recession scorekeeper—uses a broader definition and has not yet called it a recession.

“Maybe we’ll get a little blip upward in the third quarter, but we are in a downturn, and the Fed wants a downturn because the only way it knows how to fight inflation, is by making people poorer,” Forbes added, insisting that the country is in a recession regardless of how the label is officially defined.

With the Fed widely viewed as having been late to fight inflation, Fed Chair Jerome Powell has made remarks recently underscoring the central bank’s determination to crush price pressures even if it means higher unemployment and American households experiencing “some pain.”

“Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions,” Powell said in an Aug. 26 speech.

“These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain,” the central bank chief added.

The Federal Open Market Committee convenes Sept. 21–22 for a regular policy meeting, with a decision on interest rates to be announced Wednesday.