By Jack Phillips

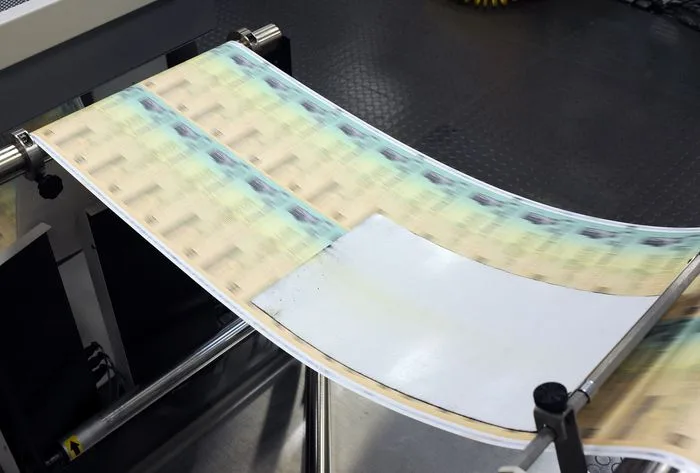

Both the IRS and the Social Security Administration (SSA) are ending the issuance of paper checks on Sept. 30 under a change initiated by the Trump administration to move toward digital payments.

Less than 1 percent of all Social Security beneficiaries receive paper checks, the SSA has said. Meanwhile, the IRS said that only 7 percent of people who received individual refunds got them through the mail. The vast majority, 93 percent, received a direct deposit.

SSA Says It Has Reached Out

The Social Security Administration (SSA) said that it contacted recipients who receive paper checks, advising them to switch to electronic payment options before the Sept. 30 deadline.

“Electronic payments offer significant advantages over paper checks, including faster access to funds, increased security, and greater convenience,” Nick Perrine, the head SSA communications officer, said in a statement earlier this month. “Payments are deposited directly into a bank account or onto a prepaid debit card, eliminating the need to wait for mail delivery or visit a bank.”

The agency stated: “If you have no other way to receive payments, we will continue to issue paper checks. … There are no plans to pause any payments starting October 1.”

In addition to the recent change, the SSA said that it will no longer offer a “temporary check option” when it is processing initial claims.

“Beneficiaries who request an exemption from the electronic payment requirement must file a waiver with the U.S. Treasury,” by calling a phone line, it said.

Earlier this year, an SSA spokesperson told The Epoch Times that some Social Security beneficiaries will still receive checks in certain circumstances after the Sept. 30 deadline.

“We will continue to drive down paper check volume, which is less than 1 percent of total, by proactively communicating with beneficiaries about the advantages of enrolling in electronic payments and the process for doing so,” the spokesperson said. “Where a beneficiary has no other means to receive payment, we will continue to issue paper checks.”

SSA figures show that as of September, only about 398,000 beneficiaries receive paper Social Security checks. In contrast, more than 69.1 million beneficiaries receive their benefits through direct deposit.

Time Running Out to Switch

On Sept. 19, the SSA warned that people who still receive paper checks should act now “to avoid any disruption in payments” before Sept. 30 by switching to electronic payment options.

According to the SSA, people can manage or set up the SSA Direct Deposit program by using a “my Social Security” account. Supplemental Security Income recipients and beneficiaries who live abroad can call 1-800-772-1213 for assistance.

People without a bank account can use the Direct Express card, which is a type of prepaid debit card. Enrollment can be completed by calling 1-800-333-1795 or visiting www.USDirectExpress.com, according to the agency.

Social Security recipients can also fill out an application form to request benefits by check and send it to the U.S. Treasury Electronic Payment Solution Center, U.S. Department of the Treasury, P.O. Box 650527, Dallas, TX 75265-0527.

IRS to Publish Guidance

The IRS said that it will send out detailed guidance for 2025 tax returns before next year’s tax season begins, which generally occurs in late January.

“Until further notice, taxpayers should continue using existing forms and procedures, including those filing their 2024 returns on extension of a due date prior to Dec. 31, 2025,” the agency added.

People without bank accounts can opt for a prepaid debit card, digital wallet, or other limited exceptions. The IRS said taxpayers “should make sure they know their banking information or consider opening a free or low-cost account.”

When using popular tax-filing services such as TurboTax or TaxAct, people can select whether they want their tax refunds to be sent electronically.

The IRS said that it takes much longer for people to receive their refunds via paper check and added that there is a 16 times higher chance that the check is lost, stolen, delayed, or altered compared with electronic payment.

“Electronic refunds give taxpayers faster access to refunds, with payments issued in less than 21 days in most cases,“ the agency said. ”Payments may take 6 weeks or longer for refunds sent by mail.”

Trump Executive Order

Both agencies’ decisions to end paper checks are based on a March executive order issued by President Donald Trump.

The federal government’s use of paper-based payments has created “unnecessary costs; delays; and risks of fraud, lost payments, theft, and inefficiencies,” the order said, and “mail theft complaints have increased substantially since the COVID-19 pandemic.”

It cost $657 million in the previous fiscal year to maintain the infrastructure to digitize paper records, the White House said.