By Andrew Moran

Shares of chip titan Nvidia jumped about 5 percent on Oct. 29, making it the first company to achieve a $5 trillion market cap milestone.

The latest accomplishment for the tech giant reflects the company’s meteoric ascent in recent years amid the wider artificial intelligence-fueled boom in global financial markets.

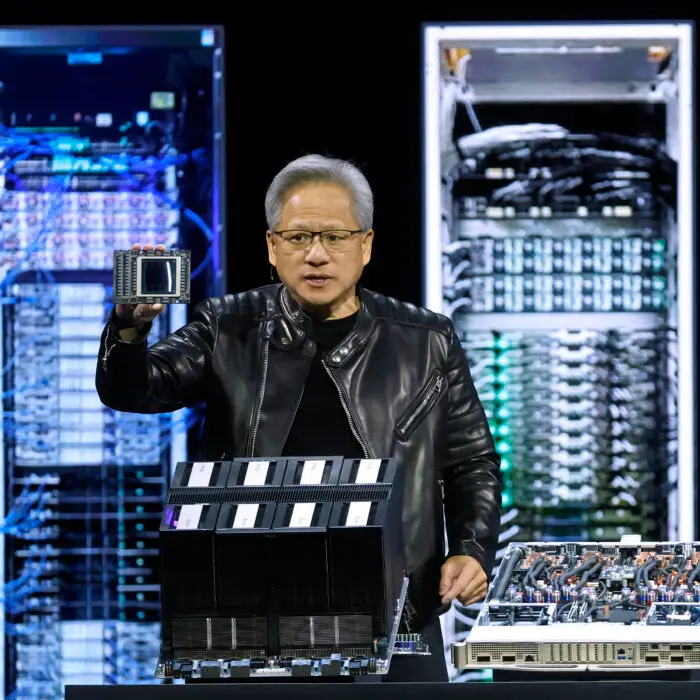

Nvidia’s recent gains were driven by CEO Jensen Huang’s projection of $500 billion in AI chip orders. He also confirmed that it will construct seven new supercomputers for the U.S. government.

The stock rose 4.5 percent at the start of the trading session, to around $210 per share. This year, Nvidia has rallied more than 51 percent.

With the Federal Reserve overwhelmingly expected to cut interest rates at the year’s final two meetings of the policy-making Federal Open Market Committee (FOMC), stocks of Nvidia and other tech behemoths will remain attractive in an easing environment, says market research firm Reflexivity.

“These growth-oriented companies benefit from lower discount rates on future earnings and cheaper capital costs,” Reflexivity said in a note emailed to The Epoch Times.

Investors are betting that the U.S. central bank will lower a key borrowing rate by a quarter point at the October and December FOMC policy meetings.

Apple Hits $4 Trillion

Nvidia’s new milestone comes one day after iPhone maker Apple reached $4 trillion in value.

Shares of Apple have increased in recent weeks as iPhone 17 models, released last month, are selling better than older models, according to industry estimates. Apple will provide the official sales figures during the Oct. 30 earnings report.

The stock rose 0.5 percent, to approximately $270 a share, adding to its year-to-date gain of nearly 11 percent.

The success of Apple, Nvidia, and other so-called Magnificent 7 companies has contributed to the broader market’s record run since the springtime selloff.

U.S. stocks rose to record levels midweek, bolstered by various tech names and the Fed’s expected rate cut.

The blue-chip Dow Jones Industrial Average and the tech-heavy Nasdaq Composite Index each advanced about 0.6 percent. The broader S&P 500 Index ticked up 0.3 percent.

All three leading U.S. stock market benchmark indexes enjoyed new record intraday highs—one day after scoring fresh all-time highs for the major averages.

“Investors are experiencing one of the most commanding momentum-driven markets since the Internet,” Eric Teal, CIO for Comerica Wealth Management, said in a note emailed to The Epoch Times.

The technology sector has accounted for 60 percent of market returns and a majority of the earnings season’s growth.

But the gains among small-cap companies suggest the rally could be expanding beyond tech, he added.

“A Fed easing cycle is now serving as an additional catalyst to spur valuations higher,” Teal said. “Thus far the gains in margins and productivity have been isolated within the technology vendors, the broadening out of the market and outperformance of small cap companies in the third quarter and October suggests the benefits are expounding.”

The Russell 2000 Index—a benchmark that tracks the performance of 2,000 small-cap U.S. firms—edged up 0.1 percent on Oct. 29 and is up more than 12 percent year to date.

Traders have also been cheering the potential easing of trade tensions between the United States and China following progress this past weekend.

President Donald Trump will be meeting with Chinese leader Xi Jinping in South Korea on Oct. 30 on the sidelines of the Asia-Pacific Economic Cooperation (APEC) Summit. The leaders of the world’s two largest economies are expected to finalize a trade framework agreement to lower tariff rates and restore agricultural trade, including soybean shipments.