By Tom Ozimek

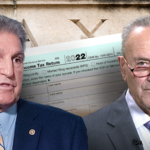

Rep. Steve Scalise (R-La.) said that the Democrat spending bill that boosts IRS funding is “guaranteed” to squeeze more tax revenue from middle- and lower-income Americans despite Biden administration insistence that households making less than $400,000 won’t face higher taxes or audit rates.

Scalise, who is the House Republican whip, made the remarks on the House floor and in an interview on Fox News on Aug. 12, the day the Democrat-controlled House passed the Inflation Reduction Act.

“The smoking gun came out this morning,” Scalise said on the House floor, referring to a statement from the non-partisan scorekeeper at the Congressional Budget Office (CBO) that reportedly confirmed that $20 billion in additional tax revenue would come from middle- and lower-income households owing to the IRS enforcement funding boost.

“It was a confirmation that the IRS agents will be getting about $20 billion in new taxes from people making less than $400,000,” Scalise said, while characterizing the CBO statement as confirmation that the bill “breaks President [Joe] Biden’s promise” that Americans making less than that amount shouldn’t worry as their taxes won’t go up.

“It’s confirmed by the CBO, and there was an amendment to stop it from happening, and every Democrat voted against it,” Scalise continued, referring to amendment 5404 (pdf) proposed by Sen. Mike Crapo (R-Idaho) that would have prevented any of the funds appropriated under the Inflation Reduction Act being used to audit taxpayers making less than $400,000 a year.

The $20 billion in additional taxes from American households earning less than $400,000 was arrived at by calculating how much less tax revenue would flow into government coffers if legislators had accepted Crapo’s amendment, according to Republicans on the House Ways and Means Committee, who disclosed part of the CBO statement.

“CBO has not completed a point estimate of this amendment but the preliminary assessment indicates that amendment 5404 would reduce the ‘non-scorable’ revenues resulting from the provisions of section 10301 by at least $20 billion over the FY2022-FY2031 period,” the CBO said, according to Republicans.

The Epoch Times has reached out to the CBO with a request for confirmation of the scorekeeper’s assessment.

‘Army of 87,000 New IRS Agents’

In an interview on Fox News, Scalise said that the reason Democrats rejected Crapo’s amendment is because they plan to squeeze more tax revenue from middle- and lower-income Americans, despite multiple statements by Biden administration officials to the contrary.

“This army of 87,000 new IRS agents … will be going after people making less than $400,000. That would break President Biden’s pledge,” Scalise told Fox News.

“It’s been guaranteed. We know that it will happen. CBO confirmed it today,” Scalise added.

It’s a view shared by Rep. Bob Good (R-Va.), who told NTD in a recent interview that middle-income Americans are going to be harmed as the “onerous and burdensome” provisions of the bill enable a legion of “hyper-motivated” IRS agents to go after Americans making less than $400,000 a year.

“I’ve never had one constituent yet tell me they wish we had more IRS agents. Most of this money will be spent on enforcement to go after Americans to harass and intimidate Americans to collect more revenue to try to pay for these terrible Democrat environmental extremist policies,” Good said.

The Republican lawmaker estimated that the tens of thousands of potential new IRS hires would result in around a million additional audits per year.

“They’ll go after the middle-income Americans who they know when they get that threatening tax letter saying you owe the money you must pay or else we’ve presumed you’re guilty,” Good said.

“They know middle-income Americans can’t hire the tax lawyers, the tax accountants to fight it. So they’ll just comply. They’ll just give in and they’ll pay. That’s what it’s intended to do, to harass and threaten, intimidate Americans,” he added.

More Tax Audits?

Treasury Secretary Janet Yellen has insisted Republican claims that tax auditors will target lower- and middle-income Americans at higher rates are politically motivated falsehoods.

“Contrary to the misinformation from opponents of this legislation, small business or households earning $400,000 per year or less will not see an increase in the chances that they are audited,” Yellen said in an Aug. 10 letter to IRS Commissioner Charles Rettig.

Yellen also said in the letter that she was ordering the IRS not to use any of the additional revenue from the legislation to increase audit rates among middle- and lower-income Americans.

“I direct that any additional resources—including any new personnel or auditors that are hired—shall not be used to increase the share of small business or households below the $400,000 threshold that are audited relative to historical levels,” she said.

The IRS chief, too, has insisted that the tax agency would “absolutely not” be increasing audit scrutiny on small businesses or middle-income Americans relative to “recent years,” according to a letter to members of the Senate on Aug. 4 (pdf).

A CBO analysis indicated that, under basically the same funding plan as is featured in the Inflation Reduction Act, audit rates would be restored to levels around 10 years ago and that audit rates would rise “for all taxpayers,” though ones with higher incomes would face the biggest increase.

IRS audit rates have fallen sharply over the past decade, with the Government Accountability Office saying in a report that rates in 2019 were about one-third of those in 2010 for all income groups, dropping from 0.9 percent down to 0.25 percent.

A CBO estimate (pdf) shows that that the additional $80 billion in funding will bring in around $204 billion in new revenue, including from enforcement.