By Terri Wu

Some have suggested that the deal amounts to government meddling in the private sector or even signals that the nation is moving away from a free market to state capitalism.

Trump administration officials have pushed back on characterizations likening the move to socialism, saying the agreement will boost U.S. leadership in semiconductors.

The deal forms part of a broader trend as Washington steps up its efforts to win the U.S.–China tech race, experts told The Epoch Times.

While they were split on how to identify the trend—state capitalism or something else—the experts agreed it was a necessary move to compete against an economy directed by a regime that doesn’t play by established trade rules.

Washington cannot win the tech race by just controlling Beijing’s access to advanced U.S. technology, the experts said. It also needs to exert pressure on China’s economic model.

For years, the Chinese regime has been flooding the global market with inexpensive products made possible by its excessive manufacturing capacity. That, in turn, makes money for tech development.

As China continues to rely on stolen technology and funding through exports, the United States has a short window of opportunity to gain a step ahead in the tech race, experts said.

Intel’s Strategic Value

Under the deal, the Department of Commerce converts its $11.1 billion grant provided to Intel under the 2022 CHIPS and Science Act into nonvoting shares. Additionally, within five years, the U.S. government has the right to acquire another 5 percent share if the company decides to reduce its ownership stake in its chip manufacturing, or foundry, business to below 51 percent. That’s the “foundry clause.”

The federal government has taken ownership of private companies before. However, that was typically done during an emergency, such as the 2008 financial crisis or the COVID-19 pandemic.

Intel’s current woes are not due to broader market conditions but poor management decisions.

The company missed out on the mobile chip market by banking on chips for personal computers, and it was late in the game for advanced artificial intelligence (AI) chips. As a result, the company announced in July that it would slash its workforce by 24,000, or 25 percent of its core employee base, by the end of this year and it recorded a $2 billion restructuring charge, leading to a $3 billion loss in the second quarter.

James Lewis, a former diplomat specializing in technology and a distinguished fellow at the Center for European Policy Analysis, calls Washington’s new approach “state capitalism.”

Intel doesn’t get new money, he told The Epoch Times, and taking a stake in Intel without a board seat doesn’t really help solve the company’s problems.

William Lee, chief economist at the Milken Institute, however, thinks it’s too early to conclude it’s state capitalism because Intel is a unique case, and the government’s ownership is passive.

Lee describes the approach as a “national defense strategy that includes economic assets.”

“China’s attack on the U.S. is most likely going to be cyber, software-related, and tech-related,” Lee, who also leads the consultancy Global Economic Advisors, told The Epoch Times. “That’s why we want to have our own tech industry. Because that’s where the battleground is going to be.”

Treasury Secretary Scott Bessent, in an Aug. 27 interview on Fox Business, said that the fact that the vast majority of the world’s advanced chips are manufactured in Taiwan posed a “national risk like we haven’t seen since the Arab oil embargo.” The 1973 crisis caused severe energy shortages in the United States and triggered a global recession.

From a national security perspective, Intel has unique value because it’s the only American shop with advanced chip design and manufacturing under one roof.

The chip supply chain consists of three main components: design, wafer production, and testing and packaging. Unlike Nvidia and AMD, which rely heavily on Taiwan for chip production, Intel owns all the steps with facilities in the United States. It also has testing and assembly sites in China, Malaysia, and Vietnam.

Washington’s move is “preemptive” in using state capital to prevent the talent and technology of a high-tech company from being transferred to other countries, Ethan Tu, founder of Taipei-based Taiwan AI Labs and a veteran practitioner in the AI field, told The Epoch Times.

Tu said the company still hosts key technologies powering central processing units, or the brains, of electronic systems.

By the same token, Lee sees Intel’s value to the U.S. government as America’s “emergency stash” or “emergency capacity.” In the event the United States were to lose access to TSMC, or Taiwan Semiconductor Manufacturing Company Limited, Intel could serve as an alternative source for talent and production, he said.

A Unique Deal

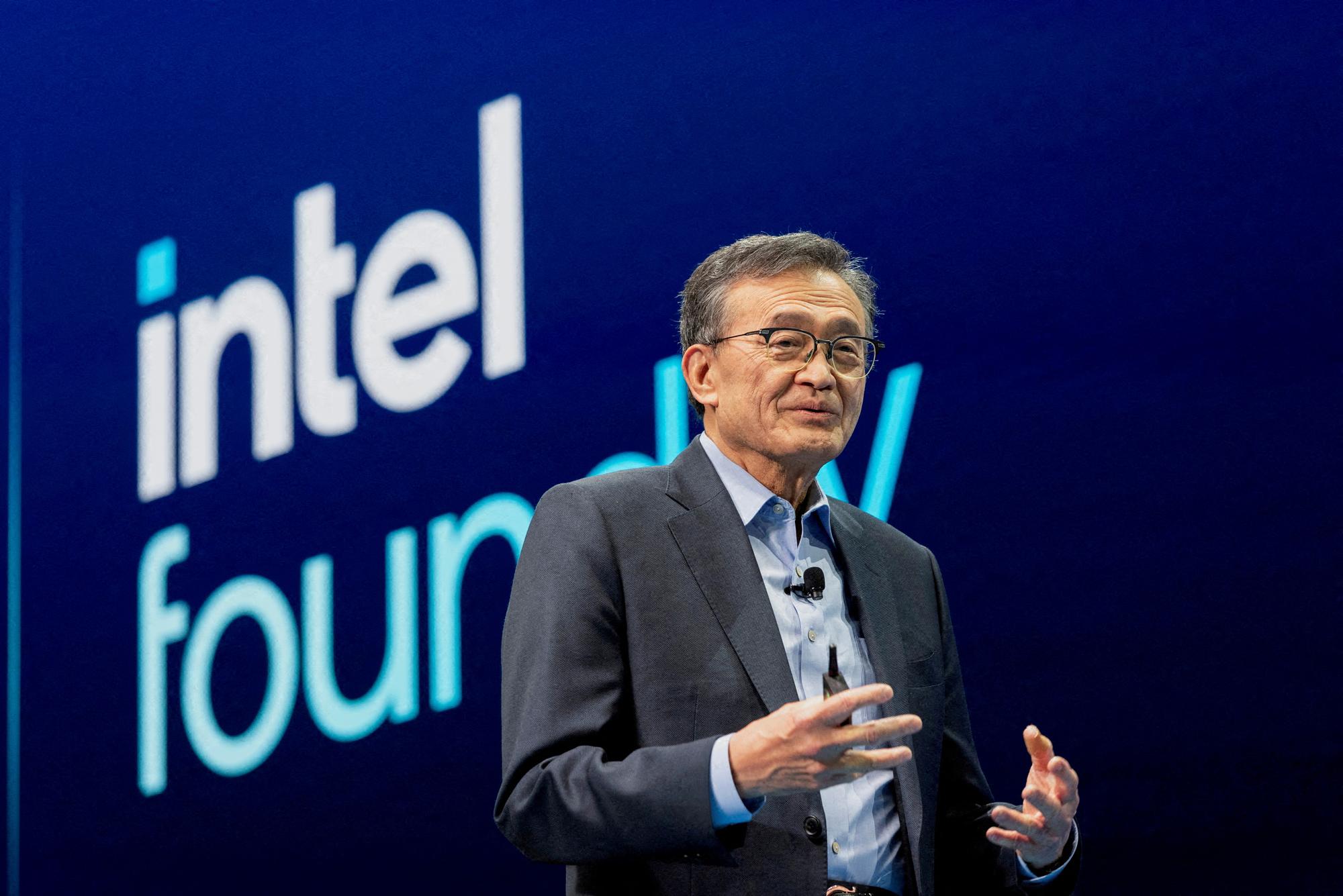

On Aug. 11, days after President Donald Trump called for Intel CEO Lip-Bu Tan to resign over alleged ties to China, the two met at the White House. Reports began to emerge about the U.S. government taking an equity stake in the company. The deal was officially announced on Aug. 22.

On the same day, Trump said he discussed the idea of a 10 percent stake with Tan during their meeting.

“He walked in wanting to keep his job, and he ended up giving us 10 billion dollars for the United States,” Trump said. “So we picked up 10 billion, and we do a lot of deals like that. I’ll do more of them.”

Investors reacted to the Intel deal with both cautious optimism and unease.

In the days leading up to the official announcement, the company’s stock had shown general upward momentum. Yet it dipped on the day the specific terms were made public on Aug. 25, before later recovering.

Intel seems to be a specific case, but the deal is still “scaring the [expletive] out of everybody,” according to Andrew King, a general partner at Bastille Ventures. He is also the president of Future Union, an advocacy group that encourages the private sector to disengage from adversarial countries, such as China and Russia.

Intel needed the money, and the government provided a capital injection that might be otherwise unavailable to the company, King said.

However, he said that it’s still “unnerving” to Wall Street because if the government wants to take a stake in another company that doesn’t need the money, can a company say “no?”

On Aug. 25, Trump told reporters that he wanted to engage in more deals like Intel’s. The next day, Secretary of Commerce Howard Lutnick told CNBC that the administration is considering owning shares in defense contractors. Bessent later said in a Fox Business interview that the administration is not interested in taking stakes in companies that don’t need financial support.

Officials at the administration have defended the Intel deal.

White House spokesperson Kush Desai told The Epoch Times that by converting federal grants into an equity stake, the administration was “ensuring that taxpayers are able to reap the upside of the federal government’s investments into safeguarding our national and economic security.”

National Economic Council Director Kevin Hassett said that the Intel deal was a “very, very special circumstance because of the massive amount of CHIPS Act spending that was coming Intel’s way,” and the company’s shares might be included in the upcoming Sovereign Wealth Fund.

For now, King sees the deal as an interesting approach. The foundry clause acts as a “poison pill” in a way to prevent Intel from divesting its chip manufacturing business, he added.

Fighting China’s Unfair Practices

The Intel deal is not the first case of a government taking a stake in the U.S. private sector.

In July, MP Materials, a Nevada-based company that owns the only active rare earth mine in the United States, announced a deal in which the Department of Defense would become its largest shareholder, with voting rights. The Pentagon also guaranteed a minimum floor price for MP Materials’ rare earth elements and a minimum profit for its new magnet factory.

The rare earth deal didn’t raise as many eyebrows. Given China’s near-monopoly in the industry, U.S. private companies wouldn’t have a viable business without such support from the government.

During the ongoing trade negotiations, rare earth magnets have emerged as a key vulnerability for the United States and other Western countries. Their strong magnetic fields, independent of power sources, are a crucial element in modern manufacturing and advanced weaponry.

In April, China banned the export of such magnets, causing slowdowns and halts in the assembly lines of U.S. automakers in the following month. Since then, Beijing has agreed to grant export licenses but has been slow walking them.

On Aug. 25, Trump threatened to impose 200 percent tariffs on China if it were to curb exports of rare earth magnets to the United States again.

Both advanced chips and rare earth magnets are essential components in determining technical leadership.

Because the tech race will be a defining aspect of the U.S.–China power competition, this new approach—involving the U.S. government taking ownership in private businesses in strategic industries—is likely to expand to more companies and sectors, according to China expert Alexander Liao.

The U.S.–China race is currently at a critical juncture, he said. In his view, China has sustained its technical development primarily by acquiring technology through theft and by dumping products from its overcapacity to generate revenue, thereby supporting its industrial policies.

Tariffs on Chinese exports have exerted significant pressure on China’s economy, shrinking its access to the overseas market. Along with export controls, this has also brought challenges to its technical sector.

Researchers in China found that the trade war during the first term of the Trump administration negatively impacted the innovation of Chinese tech companies by increasing their operating costs. The current administration has intensified its efforts this time around.

Liao said that if China’s tech sector can maintain its pace of development for another five to 10 years, then the U.S. private sector might not be able to compete, even with Uncle Sam’s support.

Lewis concurs that China is “dependent on stealing technology as much as they once were.”

China is already a peer in many tech areas, he said, despite problems with “bad investment decisions” and the “ability to create the political space for innovation.”

Lewis believes Trump correctly identified the problems stemming from Beijing but did not respond with the right fixes.

King agrees that the government owning private businesses is not an optimal solution. “You’re going in at a disadvantage with companies that are not leading,” he said.

However, King also views it as the best option available.

“My simple point of view is when your competitors and competitive geopolitical nation-states are playing dirty, then you find whatever tools you have in the toolbox to compete and win,“ he said, ”and that’s what we’re doing right now.”