By Louis Navellier

As the stock market stumbled late last week, gold rose to over $4,000 and is up over 50% so far in 2025, its best year (by far) since the inflationary bubble of 1979. Gold, opening at $4,070 on Monday, is almost 200-fold higher than it was a century ago, due mostly to global turmoil and a lack of confidence in central banks. In fact, central banks have also lost confidence in their own currencies, as they keep exchanging paper money for over 1,000 tons of gold per year, each year since 2022, at the start of the Ukrainian War.

Here are the most important developments recently and what they mean:

– President Trump rattled the stock market when he announced last Friday that he would impose an additional 100% tariff on China as well as export controls on “any and all critical software” beginning November 1st, after threatening to cancel an upcoming meeting with China’s President, Xi Jinping. Trump’s announced tariffs would raise import taxes on many Chinese goods to 130% on November 1st, which is a bit below the 145% level imposed earlier this year. Clearly, President Trump wants to negotiate a better trade deal with China.

– Then Truth Social on Sunday, President Trump said, “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment.” Trump added, “The U.S.A. wants to help China, not hurt it!!!” This comment caused Treasury bond yields to continue to decline and stocks to have a strong start this week.

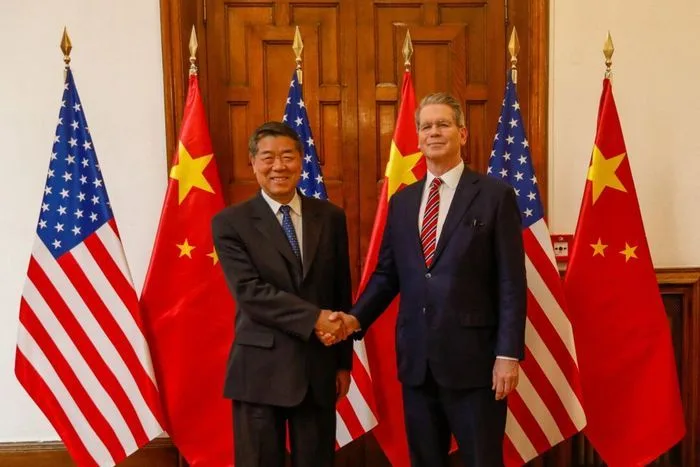

– China has imposed sweeping export controls on rare earth and critical minerals that caused Treasury Secretary Scott Bessent to accuse China of trying to hinder worldwide economic growth. What is going on is that while President Trump (as of his Sunday tweet) is trying to play the “good cop,” Bessent is playing the “bad cop.” Specifically, Bessent said, “This is a sign of how weak their economy is, and they want to pull everybody down with them.” The Treasury Secretary then added, “Maybe there is a Leninist business model where hurting your customers is a good idea, but they are the largest supplier to the world,” then concluded, “If they want to slow down the global economy, they will be hurt the most.” Finally, Bessent said, “They are in the middle of a recession/depression, and they are trying to export their way out of it. The problem is they’re exacerbating their standing in the world.”

– Currently, President Trump is on his Middle East swing and after speaking in front of Israel’s Knesset, where he praised his son-in-law, Jared Kushner, and Steve Witkoff, behind the peace deal that resulted in Hamas returning all Israeli hostages. President Trump’s next stop is Egypt, where he will be meeting with more Middle East leaders and encouraging them to join the Abraham Accords that formally recognize Israel. Like all of President Trump’s Middle East trips, he will be seeking business deals to help rebuild Israel, as well as for more countries to do business deals. Essentially, Trump is striving to replace conflict with commerce.

– The Wall Street Journal’s survey of economists forecasted fourth-quarter GDP growth at a 1.7% annual pace. This represents an improvement of their last economists’ survey in July that estimated 1% annual fourth quarter GDP growth, but also a big deceleration from the Atlanta Fed’s estimate of 3.8% annual GDP growth for the third quarter. The federal government shutdown is expected to impede consumer confidence a bit, but since the government tends to impede productivity, the shutdown may not be a significant drag on GDP growth.

– What is expected to impede U.S. economic growth and job creation is that the National Federation of Independent Business said Tuesday that its optimism index, a gauge of sentiment among small firms, fell by 2 points in September to 98.8. Economists were expecting small business sentiment to hold steady at 100.8, so the decline in sentiment was a surprise. Approximately 64% of small business owners reported that supply-chain disruptions were affecting their business to some degree. The index’s uncertainty component rose 7 points in August to 100, which is the fourth-highest reading in more than 51 years. Overall, it appears that small business caution may impede fourth quarter GDP growth.

– If the federal government shutdown persists over trying to reinstate healthcare benefits that were eliminated in the “Big Beautiful Tax Bill,” it will undoubtedly weigh on federal workers who are unpaid or terminated. The Republicans are calling the federal government shutdown the “Schumer shutdown,” and this whole mess is about trying to generate popularity heading into the 2026 midterm elections. Eventually, voters will blame both sides, so it will be interesting which side blinks first. Since federal paychecks are supposed to be received on Thursday, October 16th, it will be interesting if some paychecks do not go out, layoffs commence, and the pressure mounts to reopen the federal government with a continuing resolution while negotiations/ultimatums continue.

– The third quarter announcement season is off to a great start with major financial institutions reporting better-than-expected results. Although flagship financial stock J.P. Morgan reported a 12% increase in third-quarter earnings, it also posted credit losses of $3.4 billion during the quarter, which is the highest in over five years. J.P. Morgan allocated another $810 million in reserves for bad loans. CEO Jamie Dimon said the U.S. economy remained resilient despite some “signs of softening, particularly in job growth.” Dimon also said that the economic impact of tariffs “has been less than people expected, including us,” and added that the final outcome of tariff negotiations has yet to be seen. Investment banking boosted the bottom line for both Goldman Sachs and J.P. Morgan.

– Fed Chairman Jerome Powell is speaking today, and it is widely anticipated that he will acknowledge recent weakness in labor markets, which will effectively signal an impending key interest rate cut. I suspect Powell will also complain about the lack of economic data, especially for the consumer and wholesale inflation indices, namely the Consumer Price Index (CPI) and the Producer Price Index (PPI). Retail sales are likely softening, but that will not be announced until the federal government shutdown is over. As a result, Powell is expected to complain that the Fed is effectively flying blind due to a lack of economic data.

Overall, the last few days have been rough, and issues with China are far from over, but the earnings results are encouraging, the low energy prices are good for inflation, and expectations for sustained cuts by the Fed are a very positive development. The trend remains positive, and if earnings go well, no one will be surprised to see new highs by year’s end.

*Views expressed in this article are opinions of the author and do not necessarily reflect the views of USNN World News.