By Kevin Stocklin

Many investors opt for index funds in the belief that, by doing so, they are diversifying their risk across a broad segment of companies and industries. Increasingly, however, that is no longer the case.

Companies involved in information technology or communication services now comprise about 43 percent of the S&P 500 index by market capitalization, according to a September report by U.S. Bank Wealth Management. Seven tech companies alone—the so-called “Magnificent Seven” of Alphabet (Google), Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—now represent about 36 percent of the total market cap of the index, up from a 12 percent share in 2015.

“The risk profile of the index increasingly reflects the fortunes of those companies rather than the broader U.S. economy,” Peter Earle, senior economist at the American Institute for Economic Research, told The Epoch Times. “In practice, investors may not be receiving the same level of diversification that such [index] funds are traditionally assumed to provide.”

In addition to the concentration in these few companies, much of the recent appreciation in U.S. shares has been driven by one technology—artificial intelligence (AI).

AI-affiliated stocks have comprised 75 percent of all returns in the S&P 500, as well as 80 percent of earnings growth and 90 percent of capital spending growth, since the launch of ChatGPT in 2022, according to a Sept. 24 analysis by Michael Cembalest, chair of JP Morgan’s Investment Strategy Group.

AI technology is having ripple effects on the wider economy. The construction of new data centers for AI and cloud computing now exceeds spending on office construction across the United States.

The last time markets were so highly concentrated was during the apex of the dot-com bubble in 2000, when the top 10 companies comprised 27 percent of the index, and tech companies represented 47 percent of the index, again by market capitalization. When that bubble burst, the S&P 500 fell 49 percent from its peak, wiping out approximately $5 trillion in market value.

AI ‘Circularity’

In addition to market concentration, financial analysts have raised concerns about what is referred to as “circularity” within the AI industry.

Fund manager David Bahnsen explained on his Dividend Cafe podcast that “the lion’s share of investor gains so far have come about as some companies sell the powering ability of AI to customers called hyper-scalers.”

“And the stock of hyper-scalers has gone up because of their large purchases of AI computing power,” he said.

“So, in one easy summary, some companies are going up because they are selling AI computing power to customers, and the customers are going up because they are buying AI computing power from sellers.”

People take pictures of Amazon Echo smart speakers, which are AI-powered, during a product event in New York City on Sept. 30, 2025. Charly Triballeau/AFP via Getty Images

The “hope and promise” of this new technology has attracted more capital to AI-affiliated companies, driving up their share prices, Bahnsen said. And many fund managers point to these higher valuations, rather than real-world increases in productivity and profit, as validation of their investment thesis.

According to an August report by investment advisor Kingsview Partners, U.S. investment in AI exceeded $100 billion in 2024 and hundreds of billions more has been announced in 2025, exceeding the entire GDP of many countries.

And increasingly, this capital spending is driving share price appreciation.

“In recent quarters, investors have reacted positively to announcements of ever-higher AI infrastructure spending,” the report stated. “This is a significant shift from less than a year ago when investors were worried about whether these investments by large companies would pay off.”

Market watchers don’t dispute that AI has the potential to transform the economy, generating groundbreaking innovations, efficiencies, and profits in health care, financial services, manufacturing, logistics, retail, and transportation, among other sectors.

The question is how quickly and to what extent the capital now being spent on technology and infrastructure will generate real-world profits.

“AI has enormous potential to reshape productivity, reduce costs and generate new revenue streams, but the scale and timing of those gains remain uncertain,” Earle said. “Current valuations are pricing in rapid adoption of substantial profits that may prove optimistic if implementation proves slower or less transformative than expected.”

Cembalest outlined a scenario to illustrate the point.

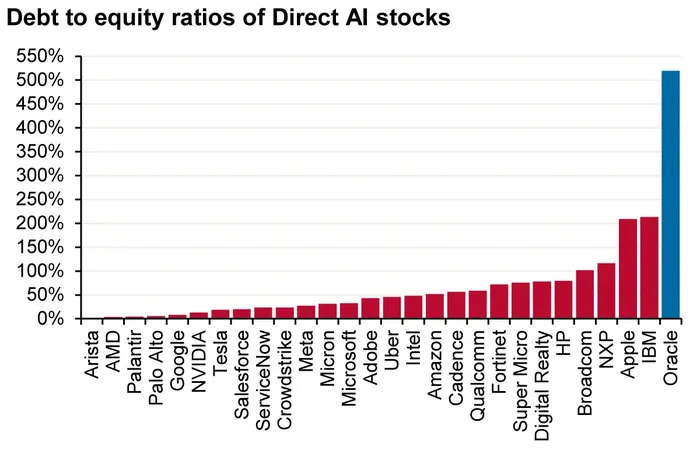

“Oracle’s stock jumped by 25 percent after being promised $60 billion a year from OpenAI, an amount of money OpenAI doesn’t earn yet, to provide cloud computing facilities that Oracle hasn’t built yet, and which will require 4.5 GW of power (the equivalent of 2.25 Hoover Dams or four nuclear plants), as well as increased borrowing by Oracle whose debt to equity ratio is already 500 percent,” he said.

Familiar but Different

That doesn’t necessarily mean the current market is set to crash, however.

Referencing the dot-com crash in 2000, Kingsview Partners stated that “when reality didn’t meet expectations, the Nasdaq fell 78 percent from its peak, and many companies failed or were acquired.”

“Yet the internet did transform the economy, just not within the timeline or in the manner that peak valuations implied.”

Analysts say there are significant differences between the current market and the dot-com market of 2000.

“Today’s leading firms are profitable, cash-rich, and already dominant in global markets,” Earle said. “During the dot-com era, many of the high-flying young internet firms had no revenue, earnings, and in some cases even their products were questionable.

“Today, though, the risk is that investors extrapolate early gains too far, creating a cycle of exuberance that is inevitably followed by a correction.”

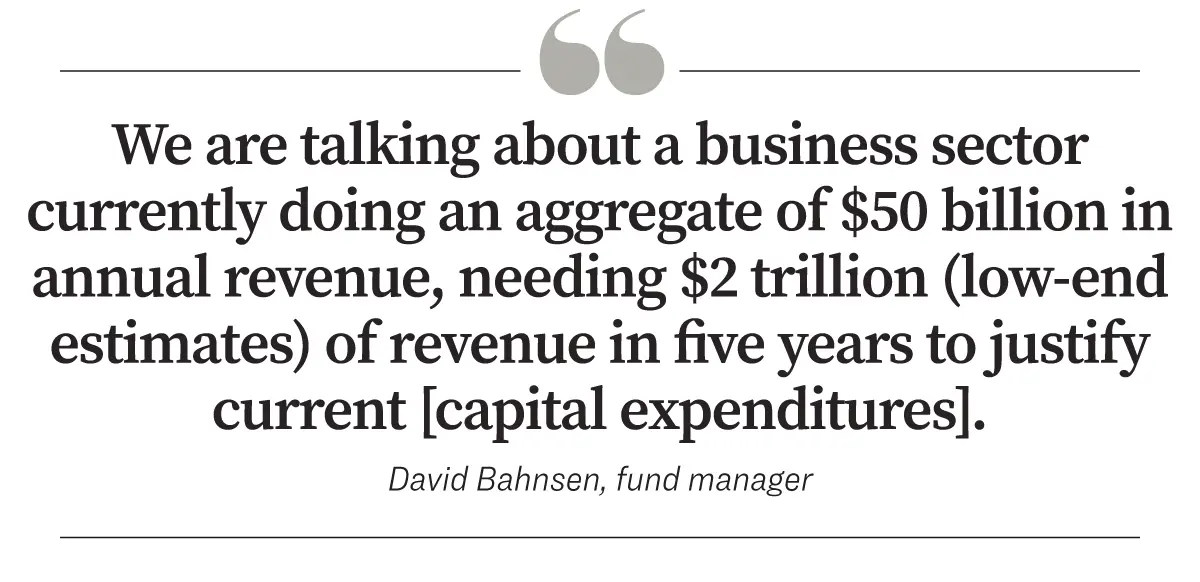

Bahnsen estimated how much revenue the tech industry would have to earn to justify today’s share prices.

Noting that AI hyper-scalers are currently trading at market valuations between 29 times and 241 times earnings, and that AI chip designers are trading between 58 times and 125 times earnings, he states: “We are talking about a business sector currently doing an aggregate of $50 billion in annual revenue, needing $2 trillion (low-end estimates) of revenue in five years to justify current capital expenditures.”

Getting Back to Diversification

For those who want to rush for the exits, however, there is a word of caution on Wall Street about betting against market rallies: “If you’re right too soon, you’re wrong.”

Fund managers who have lived through previous market crashes note that, just because prices may be inflated at the moment doesn’t mean they won’t go higher.

“Even if the market is in a ‘bubble,’ it can continue to rally for a long time,” William Flaig, financial advisor and co-founder of the American Conservative Values ETF, told The Epoch Times. He notes that even after then-Federal Reserve Chair Alan Greenspan warned in 1996 that stock valuations were driven by “irrational exuberance,” markets continued to rally for another four years before the bubble finally popped in 2000.

“It’s better to be a smart, opportunistic investor when the market corrects, rather than guess when it will correct,” Flaig said.

Earle said, in the meantime, if investors want to dial back their exposure to AI, they “should consider equal-weighted index funds.”

Earle said, in the meantime, if investors want to dial back their exposure to AI, they “should consider equal-weighted index funds.”

This should “reduce concentration by giving each S&P 500 stock the same weight regardless of their size,” Earle said. “Sector-specific ETFs, such as those focused on industrials, healthcare, or value stocks, can also provide exposure to parts of the economy less dominated by AI.”

Flaig suggests investors also consider adding defense sector funds or mid- and small-cap funds to their portfolios, as well as fixed-income investments such as U.S. Treasuries.

“If the market does falter, the Fed will likely lower short-term interest rates in response, which historically has been a positive environment for fixed-income,” Flaig said.