By Andrew Moran

U.S. stocks and gold have both reached record highs, reflecting a bifurcated investor mindset: optimism in risk assets alongside a flight to safety.

Since the springtime tariff-driven sell-off, the U.S. stock market has been booming. The blue-chip Dow Jones Industrial Average, the broader S&P 500, and the tech-heavy Nasdaq Composite Index have been routinely registering fresh record highs this year.

Gold has been shining bright throughout 2025, topping $4,000 per ounce for the first time. Silver, the sister commodity, recently reached $50 per ounce, the highest level since the aftermath of the global financial crisis.

The rally in equities and the yellow metal either spotlights the divergence in traders’ views on the broader economic climate or the start of a fresh asset price boom.

Various metrics suggest that Wall Street’s ebullience is justified.

A Divided Look at the Economy

After coming off a 3.8 percent expansion in the second quarter, the Federal Reserve Bank of Atlanta’s GDPNow model estimate indicates that the U.S. economy is poised for another 3.8 percent increase.

While consumers are cautious about the current landscape—the University of Michigan’s consumer sentiment index is at a four-month low—data suggest that they are still opening their wallets.

Retail sales, for example, have risen for three straight months. The August reading topped market expectations. Total credit and debit card spending per household, according to the Bank of America Institute, rose by 2 percent year over year in September.

The main weakness that has captured the market’s attention is the labor market.

Because of the U.S. government shutdown, key economic metrics have not been released. However, data before the closure pointed to rapid deterioration of employment conditions, prompting the Federal Reserve to implement a “risk management” interest rate cut in September.

Monetary policymakers and investors have been relying on private sector alternatives. Payroll processor ADP reported that private companies eliminated 32,000 jobs in September.

But while the Fed has presented a conservative outlook for interest rates, a further worsening of the labor market might prompt the institution to engage in a more aggressive rate-cutting campaign.

Still, traders are optimistic that rates are coming down.

Data from the CME FedWatch Tool show the futures market overwhelmingly penciling in another quarter-point rate cut to the benchmark federal funds rate. This key policy rate influences borrowing costs for businesses and consumers.

Policymakers anticipate that the median policy rate will settle at about 3 percent by the end of 2027, according to the updated Summary of Economic Projections, released in September.

At the same time, gold is a safe-haven asset, meaning that investors will seek shelter when turbulence unfolds in the U.S. and global economies.

One development that has captured attention is the fierce gold appetite among central banks.

According to the World Gold Council, central banks added a net 19 tons to global gold reserves in August.

The organization’s latest Central Bank Gold Reserves Survey, released this past summer, revealed that 95 percent of respondents believe that global central bank reserves will increase over the next 12 months.

As a result of the fierce central bank gold buying over the past several years, these institutions now hold as much gold as U.S. Treasury securities.

Central banks, the survey found, anticipate moderate or significantly lower U.S. dollar holdings over the next five years. Conversely, they project that their gold holdings, as well as their share of other nondollar currencies, will rise over this span.

In addition to its safe-haven status, gold can also serve as a tool for portfolio diversification and inflation hedging.

Ultimately, the narrative in the global financial markets heading into 2026 could be a debate on caution versus speculation à la the dot-com bubble.

“There’s a lot of focus on the speculative excesses in certain corners of the market, particularly everything related to AI [artificial intelligence] participants talking about good bubbles versus bad bubbles,” Chris Marangi, co-chief investment officer of value at Gabelli Funds, said in a note emailed to The Epoch Times.

“Excusing bubbles is the ultimate bubble behavior, but I don’t disagree with the point that there is some justification for the significant investment going into AI.”

Asset Boom

In the 1980s, the economies of Japan and China had an enormous asset boom, driven by a mix of speculation, capital inflows, monetary easing by the central banks, and liberalization of markets. This produced wealth in various sectors, particularly in real estate and stocks.

Could the United States witness a similar investment explosion?

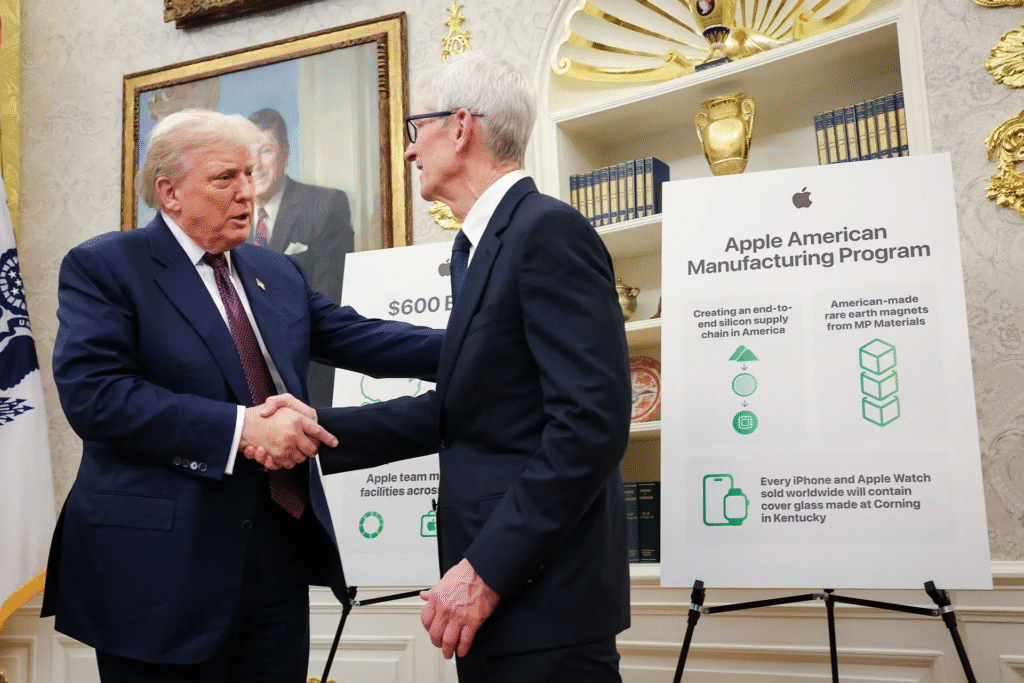

This year, President Donald Trump has attracted trillions of dollars in domestic investment in manufacturing, from Apple’s $500 billion to Merck’s $1 billion.

The world’s largest economy is also experiencing a surge in capital expenditures (CapEx). This represents companies purchasing, maintaining, or upgrading long-term physical assets such as equipment, technology, property, and buildings.

In the first half of 2025, CapEx spending increased by almost 17 percent. Treasury Secretary Scott Bessent called it a CapEx “comeback,” saying the numbers signal “a major investment wave underway.”

A sizable share of this investment is concentrated in the buildout of AI infrastructure, data centers, and manufacturing among the biggest names in tech. Whether this is sustainable remains to be seen, said Joe Tigay, portfolio manager of the Rational Equity Armor Fund.

“The CapEx momentum question looming over these giants is valid,” Tigay said in a note emailed to The Epoch Times. “They’re spending at unprecedented levels to build out AI infrastructure.

“But the real question isn’t whether they can beat Q3 estimates—it’s whether they can provide bullish 2026 guidance that justifies this massive capital deployment cycle continuing for another 12 to 18 months.”

Other developments, such as a substantial increase in AI-driven venture capital funding and foreign direct investment, support the case that the United States is experiencing an investment boom.

If so, the nation could enjoy a prolonged, broad-based boom, including in stocks and gold.

But caution is always warranted during boom times, according to Tigay.

“When everyone is talking about something as an obvious trade, it’s usually time to be cautious,” he said.