By Tom Ozimek

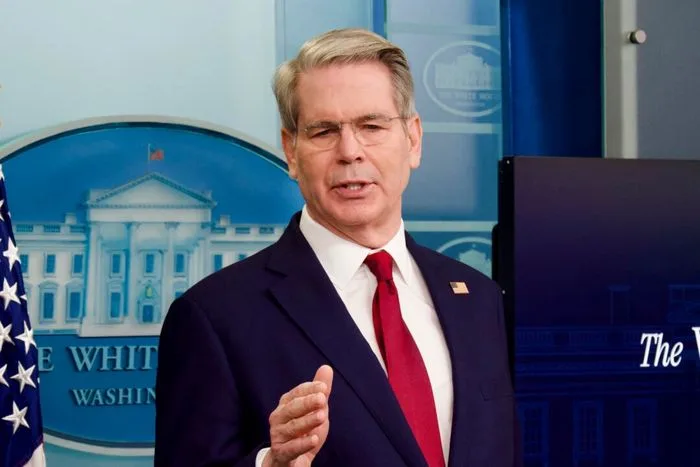

Treasury Secretary Scott Bessent ramped up his criticism of the Federal Reserve on Sept. 5, accusing it of running risky “gain-of-function” monetary experiments that warp financial markets, reward asset holders, and erode the central bank’s independence.

In a Wall Street Journal op-ed, and a longer essay and interview for The International Economy, Bessent said the Fed should be stripped of its bank-supervision powers, forced to scale back its use of unconventional monetary tools, and returned to a narrow focus on interest rates and inflation.

He called for “an honest, independent, nonpartisan review of the entire institution, including monetary policy, regulation, communications, staffing, and research.”

Politics and Overreach

Bessent said the central bank had strayed far beyond its statutory mandate, beginning with the 2010 Dodd-Frank Act, which made the Fed the dominant regulator of U.S. finance. That expansion, he said, pulled the Fed into politics and social justice, creating conflicts between its regulatory and monetary roles.

“In the last decade and a half, the Fed decided to expand its remit—inserting itself into contentious social and political debates,” Bessent said.

“It most notably started with the 2010 Dodd-Frank Act, which significantly expanded the Fed’s regulatory and supervisory powers. The Fed began to experiment in areas like climate change.”

Those changes, he said, set the stage for costly failures such as the 2023 collapse of Silicon Valley Bank, when supervisors flagged vulnerabilities but failed to escalate the issue.

In Bessent’s view, the arrangement creates a structural problem: The Fed both regulates and lends to the same institutions, blurring accountability.

Instead, bank oversight should return to the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency, he said. Empowering both of these institutions would “sharpen accountability, rebuild the firewall between supervision and monetary policy, and help safeguard the Fed’s independence.”

‘Gain-of-Function’ Monetary Policy

Beyond supervision, Bessent said the Fed’s use of large-scale bond purchases—quantitative easing, or QE—amounted to dangerous tinkering with monetary policy with tools that are poorly understood. Introduced as an emergency response to the 2008 financial crisis, QE later became a routine response to problems in markets and the economy, flattening borrowing costs and inflating asset prices.

Bessent argued that continued reliance on QE fueled inflation, distorted signals from financial markets, and entrenched dependence on the Fed’s balance sheet.

“Common sense would have urged the Fed to stop,” he said. “But due to groupthink, there were no [Federal Open Market Committee] dissents during this time.”

Bessent described QE as “inherently fiscal and political in nature,” saying it effectively picks winners and losers. In his view, any future use of QE should be subject to broader government approval rather than left solely to the central bank.

Forecasting Failures

The treasury secretary also criticized the Fed’s forecasting record. Over the past 15 years, he noted, its economic projections have consistently overshot growth and badly underestimated inflation. He said the Fed’s Summary of Economic Projections (SEP) misleads markets more than it informs them.

“The Summary of Economic Projections is an embarrassment and should be ended,” Bessent said.

“One of my most successful private sector trading strategies was taking the opposite position of the SEP.”

He argued that the Fed placed too much faith in flawed models and its own communication strategy, while neglecting basic supply-and-demand dynamics.

Accusing the Fed of arrogance, Bessent said its misguided reliance on abstract forecasts over common-sense economics has made monetary policy riskier.

“To safeguard its future and the stability of the U.S. economy,” Bessent said, “the Fed must reestablish its credibility as an independent institution and approach its mission from a position of humility.”

Inequality and Independence

Bessent said the Fed’s various post-crisis experiments tilted the playing field in favor of the wealthy and made inequality worse. By boosting asset values, QE enriched wealthier households and corporations, while younger and working-class Americans faced higher borrowing costs and surging prices.

“The Fed’s actions disproportionately benefited those who already owned assets, while less-well-off or younger households missed out on the asset appreciation that benefited wealthier households,” he said.

“After the Covid-19 pandemic, working-class households faced higher interest rates and higher inflation, both a result of the Fed’s actions and inaction.”

That, Bessent said, has left the Fed more politically exposed than ever. By revamping its policies to include fighting climate change and pushing for “broad-based and inclusive” maximum employment, the central bank risked losing its reputation for neutrality.

“Whether intended or not, the Federal Reserve’s decision to engage in political activity provoked legitimate criticism that undermines its ability to retain independence on its core mission of monetary policy,” Bessent said.

Independence is “the cornerstone of sustainable economic growth and stability,” he said, adding that markets can only function properly if they believe the Fed makes decisions based on data rather than political calculation.

Call for Change

Bessent concluded that the Fed must fundamentally reorient its approach. He called for the abandonment of overly complex policies in favor of simple, measurable tools tied closely to its statutory mandate of stable prices, maximum employment, and moderate long-term interest rates.

“The Fed must change course,” he said.

“Gain-of-function monetary policy must be replaced with simple and measurable policy tools. This will safeguard central bank independence over time.”

Bessent added that credibility can only be restored through accountability. “Good stewardship is earned, not jawboned,” he said.

The Fed did not respond to a request for comment.

Bessent’s remarks come as President Donald Trump weighs potential successors to Fed Chair Jerome Powell, whose term expires in May 2026. Trump said he initially considered Bessent for the role, but the treasury secretary said he would prefer to stay in his current post.

The president has signaled he wants a new chair who is more inclined to lower interest rates, a point on which he has repeatedly clashed with Powell. The Fed has held its benchmark rate steady at 4.25 to 4.50 percent for five straight meetings, amid Trump’s calls for aggressive cuts to spur growth and ease borrowing costs.

Powell has defended the Fed’s approach, saying it must wait for clearer evidence on the economy and the impact of global tariffs before moving.

Bessent, by contrast, urged the FOMC on Aug. 12 to cut rates by half a percentage point in September and follow with additional reductions totaling at least 150 basis points. With headline inflation at 2.7 percent in July and core at 3.1 percent, he argued that price pressures are contained and the bigger risk lies in delaying action.