By Terri Wu

At this year’s G7 summit, European Commission President Ursula von der Leyen held up a symbol of the West’s bid to gain supply chain independence from China: a rare earth magnet.

“It was manufactured in Estonia, by a Canadian company using raw materials sourced from Australia and supported by the EU’s Just Transition Fund,” the European Union chief told the other heads of state, including President Donald Trump, on June 15.

The fund provides financial support for the EU’s goal to achieve net-zero emissions of all greenhouse gases.

China accounts for 90 percent of the refining of the world’s rare earth elements, according to the International Energy Agency. A rare earth magnet produced from an alternative supply chain is noteworthy.

Heat-resistant magnets are one way these critical minerals are utilized. Rare earth elements are essential to modern manufacturing, and without them, consumers will likely face shortages of cars and electronics that rely on them for screens, batteries, and motors.

The same goes for advanced weapon systems. An F-35 fighter jet needs more than 900 pounds of rare earth elements, and a nuclear-powered attack submarine needs more than 9,000 pounds of the metals, according to the Department of Defense.

Rare earths are not named “rare” because they are scarce in the Earth’s crust but because they occur naturally at low densities and are costly to separate from other metals.

China doesn’t just dominate the mining of these elements but the entire value chain, which includes separating and refining rare earths, as well as manufacturing magnets.

Based on its near-monopoly, Beijing has weaponized rare earths in the U.S.–China trade war.

Despite agreeing in Geneva in May and in London in June to provide the United States with these metallic elements, the materials are still not flowing at the same level as before Beijing imposed export controls in April.

At the same time, the Trump administration is proceeding with deregulation and investment to nurture a domestic supply chain. The United States recognized China’s dominance in critical minerals during the Obama administration in the 2010s and, during the Biden administration, introduced manufacturing tax credits and federal loan assistance under the Inflation Reduction Act.

Experts say the West’s determination to establish an alternative rare earth supply chain has now reached a watershed moment—it will not relax its efforts, as it did in the past, even if China were to lift its export controls and again flood the market with cheap products.

The U.S. initiative to achieve supply chain independence on rare earths is proceeding with “100 percent certainty,” according to Ken Mushinski, CEO of Rare Element Resources, which mines and processes rare earth elements in Wyoming.

“There is an extreme interest, and they completely understand the need for a domestic supply chain,” he told The Epoch Times, based on his recent meetings with Secretary of Energy Chris Wright and at the Pentagon.

“Every person, every department I meet with in Washington D.C., in the state of Wyoming, all are in lockstep that this is a critical initiative that needs to be fully implemented sooner rather than later.”

Rare Element Resources is operating under a cost-sharing agreement with the Department of Energy for a demonstration plant. The company anticipates commencing full-scale commercial production within two to three years.

Two years is the timeline by which the United States may start showing solid progress in building a domestic rare earth supply chain, according to tech expert James Lewis, a distinguished fellow at the Center for European Policy Analysis.

He told The Epoch Times that people will go into the rare earth business if “there’s money to be made” and “if they think the regulatory obstacles have been removed.”

Racing Against Time

Since the start of his second term in January, President Donald Trump has issued 11 executive orders that provide permitting relief and funding to businesses involved in mining and refining critical minerals.

At the end of June, the Department of Energy announced new guidance on the National Environmental Policy Act (NEPA) to streamline the permitting process for mining businesses. Two months before that, the Department of the Interior added critical minerals infrastructure projects to an Obama-era fast-tracking program, in coordination with the Permitting Council.

Mushinski said mining and refining businesses will now be able to sit down with all federal approvers involved in environmental reviews and discuss the timeline before starting a project. That saves businesses time navigating complicated processes and coordinating with different agencies. The Permitting Council, which was established by Congress in 2015 and reports to Congress, holds each agency accountable for implementing the review plan.

That could result in a difference of years, by Mushinski’s estimate. For example, it took his company 10 years to get the permit for his project in northeastern Wyoming. Under the new process, the same project might be fully permitted within two to four years.

A seven- to 10-year permitting delay is typical for critical mineral companies, according to Alex Herrgott, president of the Permitting Institute.

Funding availability also helps fast-track projects. For example, Critical Metals Corp. announced in June that the U.S. Export-Import Bank is reviewing a $120 million loan for the company’s Tanbreez rare earth mine in Greenland.

Under the new executive order to increase American mineral production, a mining project doesn’t have to have a customer “guaranteed to buy all or a portion of the output” to qualify for grants and loans, which makes the process faster, Melissa “Mel” Sanderson, a board member of American Rare Earths and co-chair of the Critical Minerals Institute, previously told The Epoch Times.

To achieve complete self-sufficiency in rare earths, Mushinski estimates that it would take between 10 and 20 years; 20 years if the United States works alone and closer to 10 if it works with allies.

He provided an example of a magnet lineup he would like to see: his company separating rare earth elements from ores on a commercial scale and an established UK metal refiner and a Japanese magnet manufacturer setting up facilities in the central United States.

The Center for Critical Mineral Strategy also proposed tapping into resources in allied countries, including manufacturers in Australia, Japan, India, and Estonia, at a congressional hearing in May.

As part of the G7 action plan, the United States will chair the 15th intergovernmental conference on critical minerals in Chicago in September.

The magnet the EU president showcased was a “good, tangible way” of demonstrating how industrial players can “work together across the board, across boundaries,” said Dennis Gibson, chairman of the Critical Minerals Association USA.

“I’m very hopeful that the session in Chicago in a couple of months will actually start solidifying and getting players together,” the industry veteran told The Epoch Times.

He noted that he will meet with other industrial organizations in mid-July to conduct preparatory work for the G7 conference.

Lost Leadership

The West is up against the near-monopoly that the Chinese regime has achieved in rare earths over the past three decades of effort.

Mountain Pass is the only active mine in the United States that extracts rare earth elements. The facility, located in California, is less than 60 miles southwest of Las Vegas and led global production from the 1960s to the 1980s.

Now it accounts for approximately 15 percent of the total global output of rare earth oxides. However, it doesn’t refine rare earths and sells the “vast majority” of its rare earth mining output to China for processing, accounting for 80 percent of its total revenue, according to the company’s 2024 annual report.

The use of rare earths in making permanent magnets, or magnetic materials that do not rely on power sources, was discovered at a lab in the U.S. Department of Defense in the 1960s. The rare earth magnet technology used today was invented in the 1980s by Sumitomo Special Metals in Japan and General Motors.

Enter China. In 1992, Deng Xiaoping, the then-Chinese Communist Party leader, said rare earths had “very important strategic significance.”

“The Middle East has oil; China has rare earth,” he said, referring to the rare earth reserves in the country.

Foreign miners were only allowed to form joint ventures with Chinese companies. And they had to provide technical know-how to the Chinese to do business in China, according to the Washington-based think tank Center for Strategic and International Studies (CSIS).

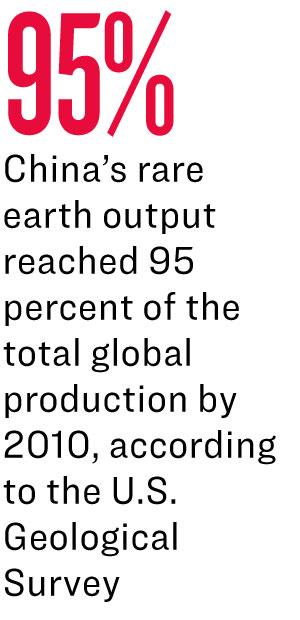

With industrial policy support, China’s rare earth output reached 95 percent of the total global production by 2010, up from 27 percent in 1990, according to the U.S. Geological Survey.

During the same year, the Chinese regime flexed its muscles in the rare earth sector.

It slashed its export quotas of rare earths by nearly 40 percent, including an embargo on Japan. That caused the prices of the critical minerals to skyrocket up to 50 times higher, CSIS reported. As a result, the stock of Molycorp, the company that owned the Mountain Pass rare-earth mine, reached an all-time high of nearly $80 per share in May 2011, according to the U.S. Securities and Exchange Commission.

However, in 2015, China retired its export quota system for rare earths. Prices fell sharply to lower than those before 2010. Molycorp filed for bankruptcy in June 2015. Years later, the mine was bought by the current owner, Las Vegas-based MP Materials, and it resumed operations in 2018.

Rare Element Resources was also affected by the last round of nonmarket “withhold and flood” practice, Mushinski told The Epoch Times. The company nearly went bankrupt in 2015 after spending $30 million acquiring permits for its Bear Lodge project in Wyoming, the company’s CEO testified at a congressional hearing in June.

When the market price collapsed, U.S. domestic players could no longer substantiate profitable business cases for investors.

Although Japan sought alternative sources of rare earths, the rest of the world ultimately returned to purchasing from China. The regime’s monopoly has remained essentially unchanged. It still refines 90 percent of the total global rare earth output today.

Times Are Different

Can China remove its export controls again to crush other industrial players and stall the current efforts to build an alternative supply chain, as it did in the 2010s?

Lewis doesn’t think so.

“The Chinese can only pull this trick off so many times before people get fed up and say, ‘We won’t depend on you.’ And that’s starting to happen,” he said. “So I think you’re going to see China’s market share erode, but it won’t erode to zero.”

Mushinski concurred.

“I think everybody realizes, you know, the deal you have today likely won’t be here tomorrow or the next day. And so everybody’s very, very wary of that,” he said.

Referring to a domestic rare earth supply chain, he noted that “the Department of Defense, the U.S. government, completely understands that this must be brought back to the United States.”

John Haughey contributed to this report.